nevada estate tax rate 2021

Under Nevada law there are no inheritance or estate taxes. Rates include state county and city taxes.

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Tax Roll - July 2021.

. All Major Categories Covered. Nevada is ranked number twenty four out of the fifty states in order. Next find the assessed value which is thirty-five percent of 6428000 or 2249800.

Processing roll corrections and property tax refunds. A person is considered to reach age 65 on the. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

Therefore the 2020-2021 taxes for this office building are 7375294. August 25 2021. The federal estate tax exemption is 1170 million for deaths in 2021 increasing to 1206 in 2022.

31 rows The latest sales tax rates for cities in Nevada NV state. Detailed Nevada state income tax rates and brackets are available on this page. The rate threshold is the point at which the marginal estate tax rate kicks.

Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. Property taxes are due on the third Monday in August. Which rate your capital gains will be taxed depends on your taxable income and filing status aka single married and filing separately married and filing jointly or head of household.

Maintaining the property tax rolls and tax allocation systems. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The Nevada income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

It is one of the 38 states that does not apply an estate tax. Ad From Fisher Investments 40 years managing money and helping thousands of families. The estate tax is a tax on a persons assets after death.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Allocating and accounting for property tax apportionments and. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value. The Auditor-Controller Property Tax Division is responsible for the calculation and preparation of the secured unsecured unitary and supplemental property tax bills.

Finally compare this tax bill with the previous tax bill. Compared to the 107 national average that rate is quite low. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20.

So we took a closer look into property taxes by state to give you a comparative look. Real Estate Tax. DUE DATES AND GRACE PERIODS.

Ad Instant Download and Complete your Probate Forms Start Now. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

In 2021 the estate tax rate. Select Popular Legal Forms Packages of Any Category. The Nevada Department of Revenue is responsible for publishing the latest Nevada.

The exemption is portable meaning that one spouse can pass his or her exemption to the other so that both spouses exemptions apply when the second spouse dies. In 2021 federal estate tax generally applies to assets over 117 million. The Nevada State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Nevada State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

084 of home value. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. However the property owner may elect to pay installments if the taxes on a parcel exceed 10000.

Property Tax Rates for Nevada Local Governments Redbook. The District of Columbia moved in the. Tax rates are set in June of each year.

You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. Cold Springs NV Sales Tax Rate. 2020 rates included for use while preparing your income tax deduction.

Tax amount varies by county. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. Here is a list of states in order of lowest ranking property tax to highest.

Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. Please verify your mailing address is correct prior to requesting a bill. The states average effective property tax rate is just 053.

Tax bills requested through the automated system are sent to the mailing address on record. Per Nevada Revised Statutes 361483. Do you have an estate plan.

Property taxes can vary greatly depending on the state that you live in. The federal estate tax exemption is 1170 million for deaths in 2021 increasing to 1206 in 2022. Carson City NV Sales Tax Rate.

Tax bills are prepared and mailed out by August 1st of each year. Nevadas property taxes are among the lowest property taxes in the united states. Boulder City NV Sales Tax Rate.

Nevada repealed its estate tax also called a pick-up tax on Jan. Jail 0774 1993 statutes of nevada page 1420 chapter 442 ab395 district courts 0192 nrs 30107 indigent health 0600 nrs 428285 indigent insurance 0150 nrs 428185 library override 0200 1994 ballot approval wc-1 effective 199596 for 30 years sccrt makeup 0000 nrs35459813 supplemental city-county relief tax. For more information contact the Department at 775-684-2000.

Missed your chance for historically low mortgage rates in 2021. Each states tax code is a multifaceted system with many moving parts and Nevada is no exception. Multiply the assessed value by the tax rate which is 32782 in Las Vegas City in 2020-2021.

It is one of the 38 states that does not apply an estate tax. Nevadas tax system ranks 7th overall on our 2022 State Business Tax Climate Index.

8912 Greensboro Ln Las Vegas Nv 8 Beds 11 Baths Las Vegas Real Estate Las Vegas Luxury Las Vegas Homes

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Mapped The Cost Of Health Insurance In Each Us State Travel Insurance Healthcare Costs Medical Insurance

Qualify For Deductions When You Buy A Home In Las Vegas Nevada Home Buying Real Estate Smart Money

We Are Accepting New Clients Schedule An Appointment Today Heights 406 969 2760 West End 406 894 2050 Taxes Payro Tax Quote Salon Quotes Business Cartoons

How To File Taxes For Free In 2022 Money

Gift Tax How Much Is It And Who Pays It

Most Expensive U S Zip Codes In 2021 10 Areas Surpass 4 Million Median Sale Price Coding Zip Code Home Buying

2022 State Income Tax Rankings Tax Foundation

How And Why To Get Pre Approved For A Mortgage In 2021 Preapproved Mortgage Buying First Home First Home Buyer

Property Tax Comparison By State For Cross State Businesses

State Local Property Tax Collections Per Capita Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Free Online Appraisal Service Of Native American Art And Artifacts By Matt Wood S Aaia Inc Native American Art American Art Native American Kachina Dolls

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

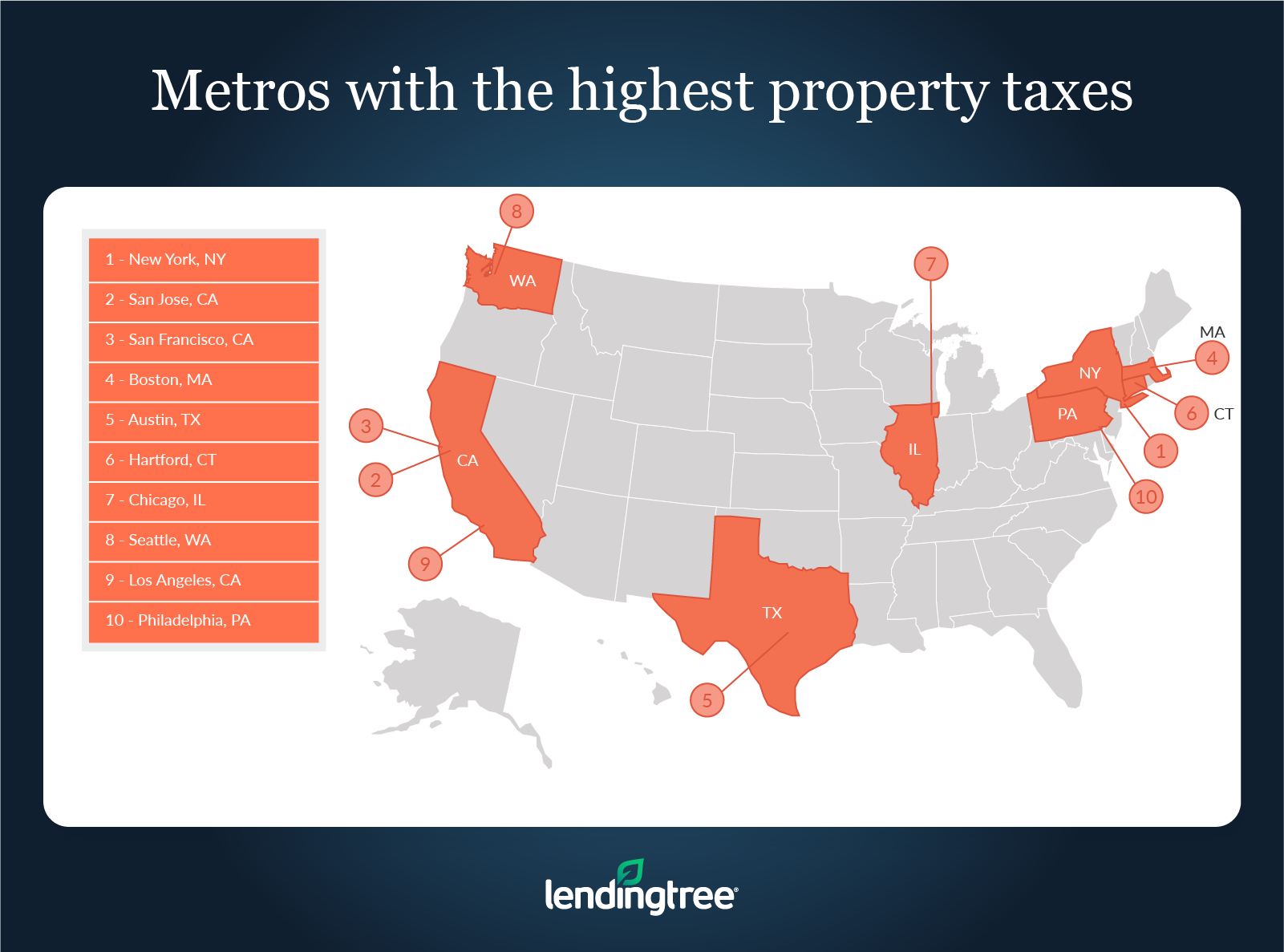

Where People Pay Lowest Highest Property Taxes Lendingtree